Financial Consulting

"Exploitation begins at home."

– The Ferengi Rules of Acquisition (Star Trek)

During the pandemic my dad and I wrote A Money Book Anyone Can Read. My dad also made me make this web page so I’m going cut and paste from our book….

Finance is more straightforward than Dad’s ramblings suggest, and what better way to show that than to have me, a teenager, explain it?

Warning: The following contains numbers. Should you wish to skip the helpful but number-full examples, you may continue reading three paragraphs down at “Alright, so…”

If you save $100 a month for 40 years, you will have saved $48,000. If you instead invest that money (in a growth and income fund with a 12% average return) you would end up with $1,176,477. This miracle of money growth is called compound interest.

“Wait… 40 years? I cannot save $100 a month for that long!” you, the imagined reader, may exclaim.

Well, dear reader, if you wait 35 years before saving at all, even if you save $800 a month (to save a total of $48,000), your savings would only grow to $65,335. A far cry from a million. So even if you cannot save $100 dollars every month, it is more important to save a little consistently than to wait until you have tons of money to start saving.

Alright, so just save and invest. Simple, right? Unfortunately, there is some unfortunate “stuff” known as income and expenses that tend to get in the way. Luckily for you, my dad can teach you about this other stuff.

Oh, and my dad likes stock photos. I should never have introduced him to Unsplash.

I was going to retire but decided to buy a new car every couple of years instead.

You don’t need to spend countless hours trying to find the newest hot stock. In fact my dad discourages people from trying to “beat the market” Again, I will “cut and paste” from our book.

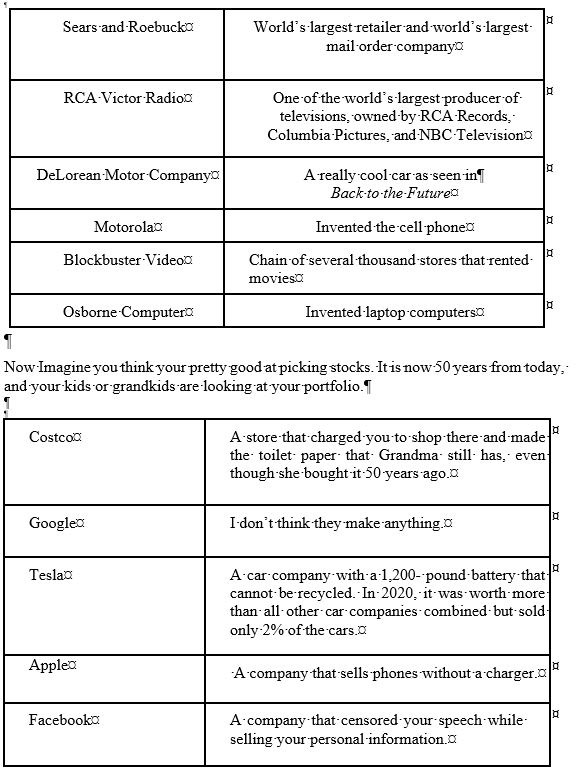

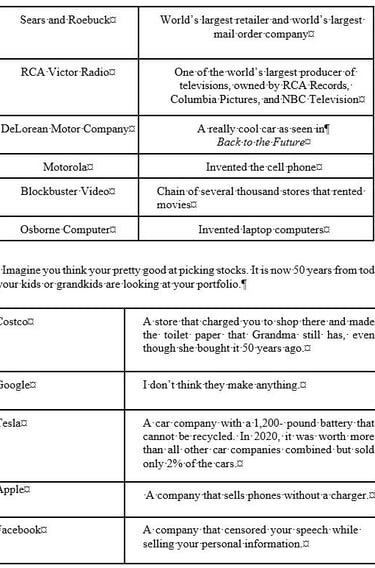

Imagine it is 1970, and your long-lost uncle comes to visit. His name happens to be Marty Mcfly, and he claims that he can travel in time. He tells you fantastic stories: people have televisions everywhere and you can pay to watch tons of movies. People can listen to any music they want at any time, computers are tiny; you can carry a phone in your pocket. Not only can you carry a phone in your pocket, but you can also use it to buy things from a giant retailer and have whatever you buy mailed to your house. Additionally, there is a really cool new car company.

With this new information, you decide to buy stocks. In 1970, you probably would have picked the stocks shown on your right. So instead of trying to beat the market buy picking the next hot stocks you can create a well-diversified, risk-based portfolio. In fact, buying individual stocks is a terrible idea. More importantly the hot stocks will be included in your portfolio if you buy mutual funds or Exchange Traded Funds (EFTs).